It’s important that everyone gets vaccinated. Even with Omicron. Actually, especially with Omicron. This seems counterintuitive given the “vaccine escape” language floating around. But vaccines are still very important. This is why…

First, our house is already on fire.

Our house is already burning from Delta. Transmission is incredibly high in 88% of counties in the United States. We have millions of people unprotected (whether they want to be or not), which is reflected by full hospitals (looking at you, Michigan) and 1,000 vaccine preventable deaths per day.

We need to address the current fire before Omicron has the opportunity fuel it. We can reduce transmission through masks, ventilation, testing and isolating. Vaccines reduce an incredible about of transmission too (see my previous post here).

Second, complete immune escape form Omicron is unlikely.

If and when Omicron comes (it’s probably already here) and if it’s a threat (pushes Delta away) that doesn’t mean we are just out of luck. Immune escape is not a binary (yes/no) event. We are not going to start from square one. This is because vaccines and our immune systems are made with mutations in mind. Immune escape is more like corrosion. I’ll attempt to explain…

First line of defense- Antibodies

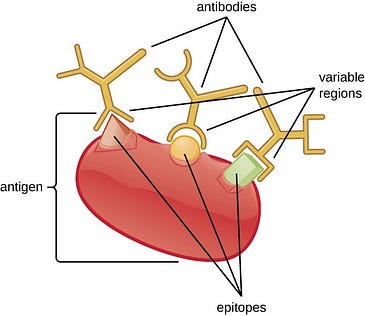

Vaccines induce something called a “polyclonal response”. Basically, the vaccine instructs the body to generate numerous shaped antibodies that can connect to many different parts of the virus (see picture). Those antibodies are diverse in shape and cover the whole waterfront of the spike protein.

Mutations to those target sites raise the possibility that the vaccines would be less effective, not necessary that they won’t work at all. Some antibodies may not attach, some antibodies may not attach as tightly, but others will. We saw this with Beta (another Variant of Concern). There were far less places for the neutralizing antibodies to attach, but some still did.

Omicron has some of the same mutations as Beta and more. Even so, we hypothesize that there is still space for these antibodies to attach. That’s because of evolution competition. For the virus to survive, it has to change enough to outsmart our vaccines but cannot change enough where the virus’s key doesn’t fit at all. If the virus is still using the same door with Omicron (ACE2 receptors), then our antibodies can probably still recognize parts of that key.

Boosters play a significant role here. They restimulate the immune system and increase the number of antibodies so more can attach. To a lesser, but important, extent boosters also generate a much broader level of immunity. In other words, boosters can develop antibodies against more parts of the virus. We saw this in a recent preprint study.

Also, the factories that make antibodies (B-cells) can adapt to new variants. Like a production factory, B-cells can modify their products as needed. So, while antibodies that are generated are highly specific, B-cells can adapt to any variant and create new specific antibodies.

How do scientists test this first line of defense?

Lab scientists in South Africa are currently answering an incredibly important question: Do vaccine-induced antibodies attach given Omicron’s 32 changes? And if so, how many neutralizing antibodies attach and how tightly? To answer this, scientists have to develop and grow a virus in the lab that mimics Omicron. This will take a week or two. But once this happens, blood from vaccinated will be mixed with the virus so we can see how antibodies respond.

Secondary response

If neutralizing antibodies can’t catch the virus before it infects our cells, then our second line of defense kicks in: T-cells. T-cell protection is harder for viruses to escape because their protection spans virtually the entire spike protein, whereas antibody responses tend to focus on relatively few regions. T-cells wouldn’t necessarily help prevent infection from Omicron, but it would help protect against severe disease and death.

Scientifically testing the second line of defense

T-cells are hard for scientists to collect and really difficult to work with in a lab. So, lab scientists aren’t currently focusing on Omicron T-cell response.

Instead, population health scientists can jump in and answer: Are vaccines protecting Omicron cases from severe disease? Interpreting real world data is incredibly difficult:

- We have to ensure interpretations are not biased. For example, in South Africa, is this case growth because we are actively looking for Omicron? Or is there a true increase in cases?

- Disease profiles can lag. Like I posted yesterday, preliminary hospitalization data in South Africa is promising. But we still have a lot of questions.

If our defense doesn’t work, we already have solutions in the pipeline

Vaccine manufacturer scientists (like Moderna and Pfizer) are tasked to answer: If our vaccines don’t provide as much protection as we would like, then what’s our solution? Several studies already underway with potential solutions:

1. Develop a new vaccine that directly responds to Omicron. Unfortunately, this solution would take the most time: develop, test, manufacture, and distribute. It’s not even clear that we need an Omicron specific vaccine.

2. Use a vaccine formula for another variant of concern. Vaccine scientists already created and tested a Beta-specific booster. Because Omicron has a lot of the same features as Beta, this vaccine has the potential to provide significant protection. We would just need to test it.

3. Use a higher booster dose. If our current boosters don’t work against Omicron (and that’s a big if), then a higher dosage of current vaccines may work. For example, Moderna is testing whether a 100 mcg booster (instead of the current 50 mcg booster) is better. This would cut a lot of manufacturing and distribution corners and we could get to this the fastest.

Bottom Line: Our immune system is an incredible, beautiful, complex, and adaptive system. We also have thousands of scientists around the world working on our questions and on solutions if we need them. Do not delay your booster appointment. Don’t delay your 5-11 year olds second shot. Our house is currently on fire and we need to respond before Omicron has the potential to fuel it.

Love, YLE

I would like to thank the amazingly brilliant Dr. Miguel Arturo Saldaña, PhD— a virologist and microbiologist that helped me think through these immune system processes and implications for Omicron. On a holiday weekend.

“Your Local Epidemiologist (YLE)” is written by Dr. Katelyn Jetelina, MPH PhD— an epidemiologist, biostatistician, professor, researcher, wife, and mom of two little girls. During the day she has a research lab and teaches graduate-level courses, but at night she writes this newsletter. Her main goal is to “translate” the ever-evolving public health science so that people will be well-equipped to make evidence-based decisions, rather than decisions based in fear. This newsletter is free thanks to the generous support of fellow YLE community members. To support the effort, please subscribe here: