KALA is a clinical-stage biopharmaceutical company dedicated to the research, development and commercialization of innovative therapies for rare and severe diseases of the front and back of the eye.

To date KALA has raised approximately $596 million, primarily from the issuance of equity. This also includes a $15 million grant from the California Institute for Regenerative Medicine (CIRM), for which the Company has received $14.4M as well as proceeds from the sale of equity of $120 million from its initial seed financing through its Series C crossover, $462 million in net proceeds after deducting underwriters’ fees from equity issued beginning with the Company’s IPO in July 2017 through December 31, 2024. In addition, KALA has raised $80 million in debt from Oxford of which $29.1 million, inclusive of exit fee is currently outstanding.

The acquisition of KALA or its assets will enable immediate access to KALA’s proprietary intellectual property, manufacturing protocols, GMP-grade master cell and working cell banks, potency-assay suite, product inventory, manufacturing know-how and trade secrets, and its Persistent Corneal Epithelial Defect (PCED) clinical trial IND approval and data. The Company believes the multifactorial mechanism of action of KPI-012 also makes its MSC-S a platform technology. KPI-012 has the potential to treat additional rare front-of-the-eye diseases, such as Limbal Stem Cell Deficiency (LSCD), and other rare corneal diseases that threaten vision. The Company has also conducted preclinical studies under its KPI-014 program to evaluate the utility of its MSC-S platform for inherited retinal degenerative diseases, such as Retinitis Pigmentosa and Stargardt Disease. As of December 31, 2024, the Company had federal net operating loss, or NOL, carryforwards of $405.5 million, which may be available to offset future federal tax liabilities and expire at various dates beginning in 2030. Additionally, the Company is eligible to receive from Alcon up to four commercial-based sales milestone payments totaling up to $325 million in connection with the July 8, 2022 sale to Alcon of Company commercial assets unrelated to KPI-012/MSC-S.

KALA’s proprietary platform is protected by a patent family comprised of 8 issued US patents and over 40 pending US and ex-US patent applications covering compositions of matter and methods of treatment and manufacture. Additionally, KALA has an exclusive license from Stanford University covering other related patent rights. KPI-012 is regulated as biologic by FDA under CBER and as such would receive 12-year regulatory exclusivity once a BLA is approved. It is assumed that any other products derived from the platform would also be subject to this exclusivity upon BLA approval.

The Company’s product candidate, KPI-012, which it acquired from Combangio, Inc., or Combangio, on November 15, 2021, is a mesenchymal stem cell secretome, or MSC-S, and is currently in Phase 2 clinical development for the treatment of persistent corneal epithelial defects, or PCED, a rare disease of impaired corneal healing. Combangio is currently a wholly-owned subsidiary of KALA. KPI-012 has received Orphan Drug and Fast Track designations from the FDA for the treatment of PCED. While preclinical data and a positive Phase 1b study support the promise of KPI-12 for the treatment of PCED, KALA announced on September 29, 2025 that its CHASE (Corneal Healing After SEcretome therapy) Phase 2b clinical trial of KPI-012 for the treatment of PCED did not meet the primary endpoint of complete healing of PCED as measured by corneal fluorescein staining or achieve statistical significance for key secondary efficacy endpoints.

The Company’s manufacturing process for KPI-012 is currently at commercial scale, with master and working cell banks established and stored at its US-based GMP contract manufacturer. Additionally, KALA has developed a suite of potency assays aligned with FDA expectations for Phase 3 and a BLA submission based on the results of the Company’s April 2024 Type C meeting with the FDA. The Company believes that its CMC, pre-clinical and clinical programs can be leveraged to support development in LSCD and other anterior segment indications outside of PCED and provide a strong foundation for developing MSC-S for the treatment of retinal disease as well non-ophthalmic indications.

IMPORTANT LEGAL NOTICE:

The information in this memorandum does not constitute the whole or any part of an offer or a contract.

The information contained in this memorandum relating to the KALA assets has been supplied by KALA. It has not been independently investigated or verified by Gerbsman Partners or its agents.

Potential purchasers should not rely on any information contained in this memorandum or provided by KALA or Gerbsman Partners (or their respective staff, agents, and attorneys) in connection herewith, whether transmitted orally or in writing as a statement, opinion, or representation of fact. Interested parties should satisfy themselves through independent investigations as they or their legal and financial advisors see fit.

KALA, Gerbsman Partners, and its respective staff, agents, and attorneys, (i) disclaim any and all implied warranties concerning the truth, accuracy, and completeness of any information provided in connection herewith and (ii) do not accept liability for the information, including that contained in this memorandum, whether that liability arises by reasons of KALA or Gerbsman Partners’ negligence or otherwise.

Any sale of the KALA Assets will be made on an “as-is,” “where-is,” and “with all faults” basis, without any warranties, representations, or guarantees, either express or implied, of any kind, nature, or type whatsoever from, or on behalf of KALA or Gerbsman Partners. Without limiting the generality of the foregoing, KALA and Gerbsman Partners and their respective staff, agents, and attorneys, hereby expressly disclaim any and all implied warranties concerning the condition of the KALA Assets and any portions thereof, including, but not limited to, environmental conditions, compliance with any government regulations or requirements, the implied warranties of habitability, merchantability, or fitness for a particular purpose. Certain consents of third-party agreements may be required to obtain and/or utilize KALA assets, and diligence regarding any such consents and obtaining any such consents are responsibilities of the buyer.

This memorandum contains confidential information and is not to be supplied to any person without Gerbsman Partners’ prior consent. This memorandum and the information contained herein are subject to the non-disclosure agreement attached hereto as Exhibit A. Please note that KALA’s equity is publicly-traded and the use and disclosure of information in this memorandum and otherwise provided may be restricted by applicable securities laws, regulations, and other limitations.

Additionally statements contained in this memorandum regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Such statements include, but are not limited to, statements regarding: KALA’s future expectations, plans and prospects, KALA’s expectations with respect to potential advantages of KPI-012 and its MSC-S platform; the clinical utility of KPI-012 for any indication; and the value of KALA’s asset. Any forward-looking statements in this memorandum is based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. Risks that contribute to the uncertain nature of the forward-looking statements include, among others, uncertainties inherent in the initiation, conduct and results of preclinical studies and clinical trials; KALA’s ability to comply with the covenants under its loan agreement, including the requirement that its common stock continue to be listed on The Nasdaq Stock Market; and those other risks and uncertainties set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2025 and June 30, 2025, and in subsequent filings the Company may make with the SEC. All forward-looking statements contained in this memorandum speak only as of the date of this memorandum. KALA anticipates that subsequent events and developments will cause its views to change. However, KALA undertakes no obligation to update such forward-looking statements to reflect events that occur or circumstances that exist after the date of this memorandum, except as required by law.

The strengths of the KALA assets are as follows:

- KPI-012 is a Phase 2 stage program. While KPI-012 did not meet primary and secondary endpoints in the CHASE Phase 2b Clinical Study for PCED, Phase 1b and pre-clinical data support its potential for the treatment of corneal disorders.

- Proprietary MSC-S platform protected by 8 issued US patents and over 40 pending US and ex-US patent applications covering compositions of matter and methods of treatment and manufacture. Additionally, an exclusive license from Stanford University covers other related patent rights.

- KPI-012 is regulated as biologic by FDA under CBER and as such would receive 12-year regulatory exclusivity once a BLA is approved. It is assumed that any other products derived from the platform would also be subject to this exclusivity upon BLA approvals.

- KPI-012 manufacturing process is currently at commercial scale, with master and working cell banks established and stored at its US-based GMP contract manufacturer.

- KPI-012 suite of potency assays aligns with FDA expectations for Phase 3 and a BLA submission based on the results of the Company’s April 2024 Type C meeting with the Agency.

- Multifactorial mechanism of action potentially makes KALA’s MSC-S a platform technology. KPI-012 has the potential to treat additional rare front-of-the-eye diseases, such as Limbal Stem Cell Deficiency (LSCD), and other rare corneal diseases that threaten vision. MSC-S platform may also have utility for inherited retinal degenerative diseases, such as Retinitis Pigmentosa and Stargardt Disease.

- As of December 31, 2024, the Company had federal net operating loss, or NOL, carryforwards of $405.5 million, which may be available to offset future federal tax liabilities and expire at various dates beginning in 2030.

- The Company may be eligible to receive from Alcon up to four commercial-based sales milestone payments totaling up to $325 million in connection with the July 8, 2022 sale to Alcon of Company commercial assets unrelated to KPI-012/MSC-S.

Intellectual Property

KALA’s proprietary platform is protected by a patent family comprised of 8 issued US patents and over 40 pending US and ex-US patent applications covering compositions of matter and methods of treatment and manufacture. These include but are not limited to secretome compositions containing certain proteins believed to be therapeutically relevant, secretomes demonstrating certain favorable performance characteristics in activity tests and secretome formulation elements. This patent portfolio has a 20-year patent term ending in 2040, with the potential for patent term extension. Additionally, KALA has an exclusive license from Stanford University covering other related patent rights. KPI-012 is regulated as biologic by FDA under CBER and as such would receive 12-year regulatory exclusivity once a BLA is approved. It is assumed that any other products derived from the platform would also be subject to this exclusivity upon BLA approval. Schedule B attached.

Fixed Assets

The Company’s fixed assets include mostly lightly used and well-maintained equipment, including many items maintained with up-to-date preventive maintenance and calibration services. The equipment served a general molecular biology and tissue culture laboratory, as well as a small pilot manufacturing group. Assets include key equipment for: 1) general molecular biology and immunoassay (e.g., plate readers, centrifuges, Ella automated immunoassay instruments, chemiluminescent imager, and plate washers); 2) tissue culture (e.g., biological safety cabinets, centrifuges, and CO2 incubators); 3) bio-processing (PBS3 bioreactor system and SF150 tangential flow filtration system, Palltronic Flowstar); and 4) general cold storage (e.g., ultra-low freezers, -20C freezers, chest freezer, refrigerators). A schedule of fixed assets is included as Exhibit C.

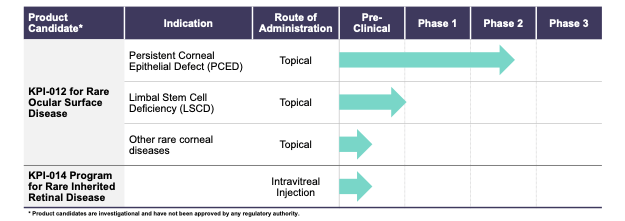

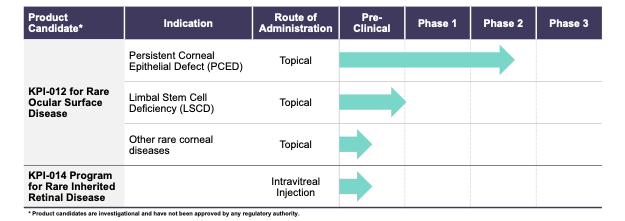

KALA Pipeline

The following table describes the stage of each of the Company’s development programs:

KPI-012 and Persistent Corneal Epithelial Defect (PCED)

KPI-012 is a novel, human bone-marrow derived MSC secretome composed of biologically active components secreted from the MSCs, such as growth factors, protease inhibitors, matrix proteins and neurotropic factors, that have been shown in preclinical studies to facilitate corneal healing. KPI-012 is cell-free and produced from a proprietary cell bank. The drug substance for KPI-012 is produced as a chemically-defined cell-free solution followed by formulation and filling of the drug product in non-preserved single dose units.

KALA believes that KPI-012’s multi-factorial mechanism of action has the potential to normalize the impaired healing in PCED and other severe ocular surface diseases driven by impaired healing. As such, KALA believes KPI-012 offers a potentially promising approach for the treatment of PCED and other ocular surface diseases across multiple etiologies. Key biological factors contained in KPI-012 and their potential wound healing functions are shown below:

| Key KPI-012 Components | Ocular Surface Wound-Healing Function |

| Protease inhibitors (e.g., TIMP-1, TIMP-2, Serpin E1) | Inhibit proteases that degrade ECM components in the wound bed and promote uncontrolled inflammatory response |

| Matrix proteins (e.g., fibronectin, collagen) | Facilitate ECM remodeling and assembly in wound bed, supporting cell adhesion, migration, and maturation |

| Growth factors (e.g., HGF) | Suppress inflammation and promote epithelial proliferation, migration, adhesion, and wound re-epithelization |

| Neurotrophic factors (e.g., PEDF) | Promote maintenance and regrowth of neurons to support corneal health and epithelial function and survival |

The multifactorial mechanism of action of KPI-012 is thought to be responsible for the significant wound healing activity observed in preclinical animal models and in the completed Phase 1b clinical trial. KPI-012 has received Orphan Drug and Fast Track designations from the FDA for the treatment of PCED.

PCED

PCED is a persistent non-healing corneal defect or wound that is refractory to conventional treatments. PCED is a disease of impaired corneal healing and can be the result of numerous etiologies, including (but not limited to) neurotrophic keratitis, or NK, microbial/viral keratitis, surgical epithelial debridement, corneal transplant surgery, LSCD, mechanical/thermal trauma and exposure keratopathy. Normal healing is a highly regulated multifactorial process that involves numerous biologic pathways and molecules, including growth factors, cell signaling, proliferation, migration and extracellular matrix remodeling. In PCED, the normal healing process is impaired due to an imbalance of the key biomolecules that orchestrate the normal wound healing process. KALA believes that effective treatment of PCED across the various etiologies requires a multifactorial mechanism of action to address the impaired healing that is responsible for the defects.

PCED is a rare disease with an estimated incidence of 100,000 cases per year in the United States and 238,000 cases per year in the United States, European Union and Japan combined. Clinical symptoms of PCED include pain, foreign body sensation, redness, photophobia and tearing. Clinical signs include non-healing epithelial defects, stromal scarring and stomal thinning. A PCED may lead to infection, corneal ulceration, corneal perforation, scarring, opacification and significant vision loss.

There is currently a significant unmet need for therapies to effectively treat PCED. Conventional therapies, which include bandage contact lenses, autologous serum and surgery, are usually ineffective in overcoming the dysregulation present in multiple cellular pathways that may need to be addressed to heal a PCED. Surgical procedures used in the treatment of PCED include tarsorrhaphy, corneal epithelial stem cell transplants and corneal transplants which are used to aid in restoration and maintenance of vision capabilities.

Competition – Oxervate

The only currently approved prescription product in the PCED space is Oxervate®, indicated for the treatment of NK, which we believe to be the primary etiology for approximately one-third of PCED cases. Oxervate contains a single growth factor – nerve growth factor (NGF) – and has been demonstrated to be effective in only the subgroup of PCED cases whose underlying etiology is neurotrophic disease. Oxervate is a topical eye drop that is administered six times per day at two-hour intervals for eight weeks. Each administration of Oxervate requires the use of a vial containing the drug product, a vial adapter, a single-use pipette and disinfectant wipes. The manufacturer of Oxervate, Dompe Farmaceutici, reported over $1.1B in Oxervate sales in 2024.

KPI-012 PCED Clinical Development

CHASE Phase 2b Clinical Study

Based on the positive results of a Phase 1b clinical safety and efficacy trial of KPI-012 in patients with PCED, along with favorable preclinical safety and efficacy results, the Company submitted an investigational new drug application, or IND, to the U.S. Food and Drug Administration, or FDA, which was accepted in December 2022. In February 2023, KALA dosed its first patient in the United States in our CHASE (Corneal Healing After SEcretome therapy) Phase 2b clinical trial of KPI-012 for PCED, or the CHASE trial.

As reported on September 29, 2025, KALA’s CHASE Phase 2b clinical trial failed to achieve statistical significance for its primary and secondary endpoints and did not show any meaningful difference between either KPI-012 treatment arm and the placebo arm. KPI-012 was well-tolerated with no treatment-related serious adverse events observed. The CHASE Phase 2b trial is a multicenter, randomized, double-masked, vehicle-controlled, parallel-group study to evaluate the safety and efficacy of two doses of KPI-012 ophthalmic solution (3 U/mL and 1 U/mL) versus vehicle dosed topically QID for 56 days. The CHASE trial randomized 79 patients across 37 sites in the United States and Latin America with verified PCEDs at baseline were eligible for inclusion in the primary efficacy analysis.

Phase 1b Clinical Study

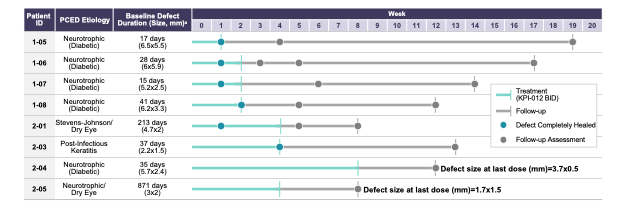

Combangio, prior to its acquisition by KALA, conducted a Phase 1b clinical trial of KPI-012 in Mexico City, Mexico during 2020 and 2021, consisting of three subjects without active corneal disease, or the safety cohort, who were dosed twice a day (1 U/mL) for one week and nine patients with PCED, or the PCED cohort, who were dosed twice a day (1 U/mL) for up to eight weeks.

The participants in the Phase 1b trial were treated with KPI-012 topically twice a day, with the subjects in the safety cohort treated for one week and patients in the PCED cohort treated between one to eight weeks. KPI-012 was generally well tolerated in both cohorts, with only one subject experiencing treatment-related adverse events (mild and transient itching, red eye and blurred vision after study drug administration). There were no deaths or treatment-related serious adverse events during either cohort. One subject in the PCED cohort had to withdraw from the trial due to a protocol screening violation.

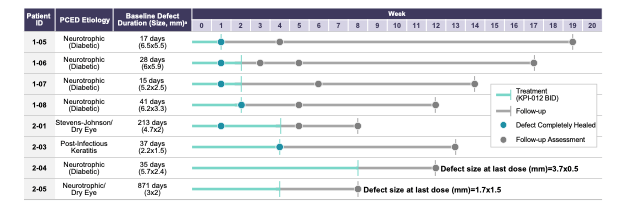

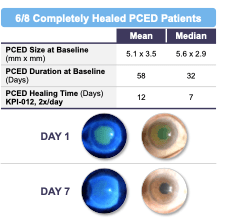

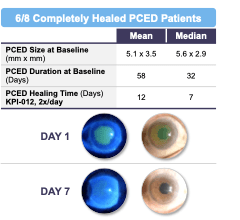

As depicted in Figure 1 below, six of the eight patients in the PCED cohort (75%) who completed the trial achieved complete healing of the lesion after four weeks of treatment, with the two other patients experiencing some clinical improvement but not complete healing. Four of eight patients in the PCED cohort (50%) achieved complete healing of the lesion after one week of treatment and the other two patients achieved complete healing within two to four weeks of initiation of treatment with KPI-012. All six of the patients who achieved complete healing remained healed through the follow-up period of the trial, which ranged between eight to 19 weeks. Of the two patients who did not show complete healing in the trial, clinical investigators noted some clinical improvement in both patients, but the corneal staining images did not show complete healing of the defect.

Figure 1. Summary of Phase 1b clinical trial of KPI-012 for PCED, including representative images for a healed patient study eye. The Day 1 images were taken on the first day of treatment, prior to first KPI-012 administration, with the fluorescein (green) stain demarking the corneal wound boundary of the study eye image. The Day 7 images were taken on the last day of KPI-012 treatment showing the PCED completely healed. The images on the left depict the study eye viewed under blue light to visualize the PCED with fluorescein stain.

KPI-012 Preclinical Studies and Results

KPI-012 was evaluated in several preclinical studies. In these studies, KPI-012 promoted rapid ocular re-epithelialization and mitigated scarring and neovascularization in several well-established animal models.

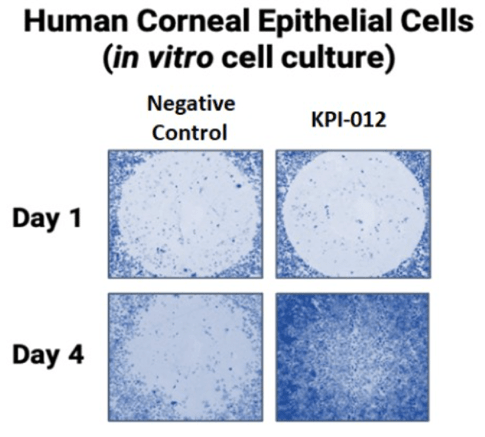

In vitro Human Corneal Epithelial Wound Closure Assay

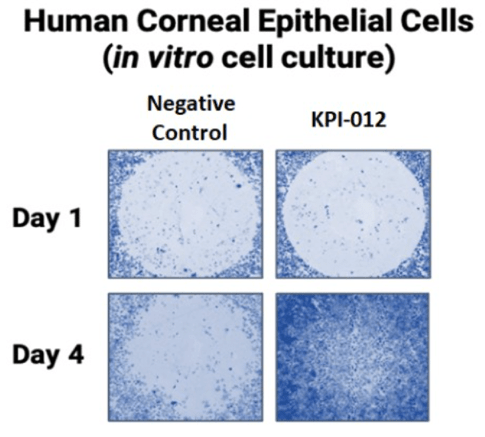

The therapeutic mechanism of action of KPI-012 involves stimulating corneal re-epithelialization and ocular surface healing. Combangio evaluated KPI-012 in an in vitro wound gap assay developed using human corneal epithelial cells. In this assay, a mechanical defect (cell-free region) was introduced into a two-dimensional monolayer of epithelial cells to create a wound. The ‘injured’ monolayer was then treated with KPI-012 and the cell free region was monitored for wound closure as show in Figure 2 below. In this assay, KPI-012 exhibited a dose-dependent and potent wound closure response.

Figure 2. Representative images from an in vitro human corneal epithelial wound closure assay. A mechanical wound instilled to a corneal epithelial cell monolayer on Day 1 healed after treatment with KPI-012 (Day 4 of treatment), but not negative control (vehicle). Depicted images are wounded cell monolayers stained with Gentian Violet.

In vivo Mechanical Wound Studies of Activity

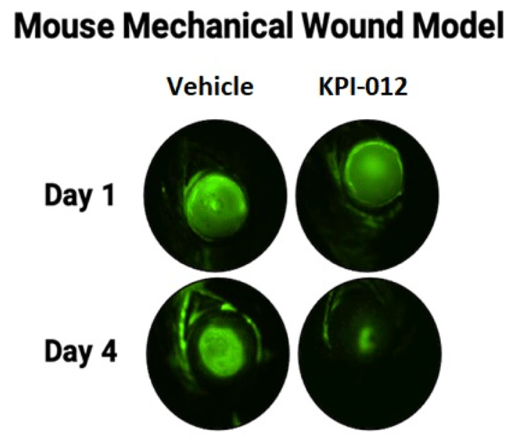

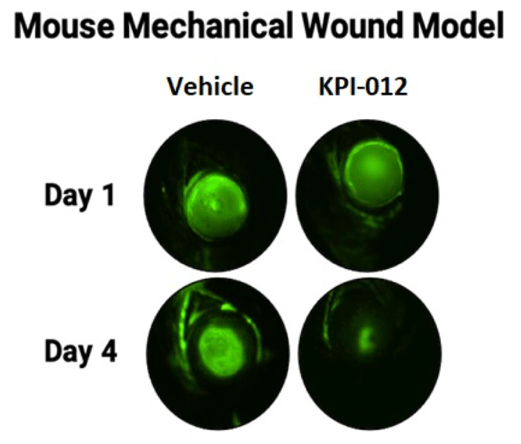

The activity of KPI-012 was also evaluated in a mechanical corneal injury mouse model. In this model, a circular area on the surface of the cornea was debrided (mechanically scraped) to remove the epithelial layer and create a circular wound.

Topical formulations of vehicle or KPI-012 were administered twice daily to the wounded eyes. As shown in Figure 3 below, mice treated with KPI-012 exhibited prominent wound healing at day four of the treatment period, while the vehicle-treated wounded eyes remained largely unhealed. Further, treatment with KPI-012 resulted in reduced corneal haze and scarring relative to treatment with vehicle. Results of this mouse model suggested that at Day 4 of treatment KPI-012 promoted in vivo closure of cornea mechanical wounds relative to vehicle control.

Figure 3. Representative images of wounded mouse corneas after mechanical injury (Day 1). Depicted is the fluorescein (green) stain, which demarks the corneal wound boundary. Treatment with KPI-012 rapidly healed the wound size (as indicated by the disappearance of the green stain by Day 4) relative to vehicle control-treated eyes.

Other Potential Indications for KPI-012 and KALA MSC-S Platform

Other Potential Indications of KPI-012

KALA believes the multifactorial mechanism of action of KPI-012 also makes it a platform technology, with the potential to treat additional rare front-of-the-eye diseases such Limbal Stem Cell Deficiency (LSCD).

LSCD is an ocular surface disease characterized by the loss or deficiency of stem cells in the junction of the cornea and limbus, where they play an essential role in the generation and repopulation of corneal epithelial cells. When the limbal stem cell population is reduced or depleted, the ability of the corneal epithelium to repair and renew itself is compromised, which can result in recurrent epithelial breakdown, neovascularization, conjunctival overgrowth and other sequalae that can lead to loss of corneal clarity and vision impairment, as well as significant pain and diminished quality of life. With the exception of the autologous stem cell product Holoclar, which is approved in the European Union for treatment of LSCD caused by ocular burns, there are currently no approved pharmaceutical products for the treatment of LSCD and there are an estimated 100,000 patients in the United States suffering from this disease. We believe these patients may be appropriate candidates for KPI-012 to maintain the integrity of the ocular surface and to avoid the vision impairment and pain associated with the disease. In addition to the effects of KPI-012 on corneal healing observed in both animal models and in PCED patients, there is data in the literature that suggest that MSC-S can restore the limbal stem cell niche, which would be of significant benefit in both partial or complete LSCD.

Other MSC-S Platform Applications

The Company also has a program targeting to develop a unique secretome formulation – designated as KPI-014 – specific for inherited retinal degenerative diseases. KALA initiated preclinical studies under our KPI-014 program to evaluate the utility of our MSC-S platform for inherited retinal degenerative diseases, such as Retinitis Pigmentosa and Stargardt Disease. MSC-S therapies have shown great promise to treat inherited retinal diseases, or IRDs, with the recognition that they function through their secretome (i.e., the secretion of paracrine factors that enhance retinal cell function and survival). KALA believes an MSC-S engineered for intravitreal delivery may provide an improved treatment option for IRDs as compared to the traditional MSC-based approach.

KALA’s MSC-S development and manufacturing program may also provide a foundation for secretome-based product development outside of ophthalmology. Published third party studies have supported the promise of mesenchymal stem cell secretome in multiple indications outside of ophthalmology, including skin wounds, lung injury, myocardial infarction, stroke and spinal cord injury.

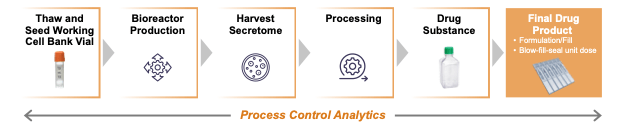

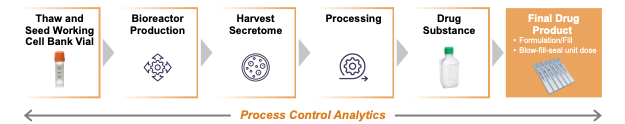

KPI-012 Manufacturing Process

The Company is currently manufacturing KPI-012 at commercial scale for PCED at two contract manufacturers, BioBridge Global (secretome Drug Substance; San Antonio, Texas) and Woodstock Sterile Solutions (filled and finished Drug Product; Woodstock, Illinois). Final Drug Product is currently manufactured using industry-standard unit dose blow-fill-seal formulation and filling process. Final Drug Product is released based on product potency, consistency and stability methods consistent with FDA Pre-IND meeting feedback, including protein Critical Quality Attributes (CQAs) and a cell-based potency assay.Validated assays have been developed for protein CQAs, with multiple engineering batches assaying CQAs and additional KPI-012 constituents supporting a robust and consistent manufacturing process. Based on a Type C meeting with FDA in April 2024, KALA’s CMC and potency assay program is aligned with FDA expectations for Phase 3 and a BLA submission. The KPI-012 PCED CMC program and other IND-enabling activities have the potential to be leveraged to support development in LSCD and other anterior segment indications outside of PCED.

Alcon Transaction

The Company previously developed and commercialized two marketed products, EYSUVIS® (loteprednol etabonate ophthalmic suspension) 0.25%, for the short-term (up to two weeks) treatment of the signs and symptoms of dry eye disease, and INVELTYS® (loteprednol etabonate ophthalmic suspension) 1%, a topical twice-a-day ocular steroid for the treatment of post-operative inflammation and pain following ocular surgery. Both products applied a proprietary mucus-penetrating particle drug delivery technology, which the Company referred to as the AMPPLIFY® Drug Delivery Technology. This technology and the associated products were unrelated to KPI-012 or the Company’s MSC-S platform.

On July 8, 2022, the Company closed the transaction (the “Alcon Transaction”), contemplated by the asset purchase agreement, dated as of May 21, 2022 (the “Asset Purchase Agreement”), by and between the Company, Alcon Pharmaceuticals Ltd. and Alcon Vision, LLC (together referred to as “Alcon”), pursuant to which Alcon purchased the rights to manufacture, sell, distribute, market and commercialize EYSUVIS and INVELTYS and to develop, manufacture, market and otherwise exploit the Company’s AMPPLIFY Drug Delivery Technology (collectively, the “Commercial Business”). Alcon also assumed certain liabilities with respect to the Commercial Business at the closing of the Alcon Transaction. Alcon paid to the Company an upfront cash payment of $60 million upon the closing of the Alcon Transaction. In addition, pursuant to the Asset Purchase Agreement, the Company may beeligible to receive from Alcon up to four commercial-based sales milestone payments totaling up to $325 million as follows: (1) $25 million upon the achievement of $50 million or more in aggregate worldwide net sales of EYSUVIS and INVELTYS in a calendar year from 2023 to 2028, (2) $65 million upon the achievement of $100 million or more in aggregate worldwide net sales of EYSUVIS and INVELTYS in a calendar year from 2023 to 2028, (3) $75 million upon the achievement of $175 million or more in aggregate worldwide net sales of EYSUVIS and INVELTYS in a calendar year from 2023 to 2029 and (4) $160 million upon the achievement of $250 million or more in aggregate worldwide net sales of EYSUVIS and INVELTYS in a calendar year from 2023 to 2029. Each milestone payment will only become payable once, if at all, upon the first time such milestone is achieved, and only one milestone payment will be paid with respect to a calendar year. In the event that more than one milestone is achieved in a calendar year, the higher milestone payment will become payable and the lower milestone payment will become payable only if the corresponding milestone is achieved again in a subsequent calendar year. The Company has not been entitled to any milestone payment to date.

Net Operating Losses

As of December 31, 2024, the Company had federal net operating loss, or NOL, carryforwards of $405.5 million, which may be available to offset future federal tax liabilities of KALA and which expire at various dates beginning in 2030. As of December 31, 2024, KALA also had state NOL carryforwards of $469.1 million, which may be available to offset future state income tax liabilities of KALA and expire at various dates beginning in 2025. As of December 31, 2024, KALA had $2.5 million federal and state research and development credit carryforwards. The Company’s NOL carryforwards could expire unused and be unavailable to offset our future income tax liabilities.

In general, under Sections 382 and 383 of the Code, the amount of benefits from the Company’s NOL and research and development tax credit carryforwards, respectively, may be impaired or limited if we incur an “ownership change,” generally defined as a greater than 50% change (by value) in equity ownership by certain stockholders, over a three-year period. KALA previously completed an analysis and determined that an ownership change has materially limited the Company’s net operating loss carryforwards and research and development tax credits available to offset future tax liabilities. During December 2022, an additional ownership change occurred as a result of the Company’s entry into the securities purchase agreement for the private placement transaction. As a result of this ownership change, the utilization of the Company’s net operating loss carryforwards is subject to an annual limitation of $0.2 million. KALA may be further limited by any changes that may have occurred or may occur subsequent to December 31, 2022, including any change resulting from the purchase of the Company has not completed an analysis as of December 31, 2024. Any buyer interested in monetizing KALA’s tax attributes should seek its own tax advice and should not rely on any statement of KALA or its advisors.

Seasoned Management Team

KALA’s management team includes:

Todd Bazemore – President & CEO

Mr. Bazemore brings over 30 years of experience across ultra-rare orphan diseases to large primary care conditions. He previously served as KALA BIO’s interim Chief Executive Officer from February 2025 to September 2025 and as its Chief Operating Officer from November 2017 to February 2025. Prior to joining the company, Todd served as Executive Vice President and Chief Operating Officer of Santhera Pharmaceuticals (USA), Inc. responsible for U.S. operations from September 2016 to November 2017. Before that, between April 2014 and January 2016, Mr. Bazemore served as Executive Vice President and Chief Commercial Officer of Dyax Corp. where he was responsible for global commercial strategy and oversight of all commercial functions up until Dyax was acquired by Shire plc. Prior to joining Dyax, he was at Sunovion Pharmaceuticals, Inc., previously Sepracor Inc. prior to its acquisition by Dainippon Sumitomo Pharma where he launched 7 new products in an 11-year span while serving in several roles of increasing responsibility including Vice President, Managed Markets, Vice President of Sales, and Vice President of the Respiratory Business Unit.

Kim Brazzell, PhD – Head of R&D and Chief Medical Officer

Dr. Brazzell has served as our Chief Medical Officer since February 2013. He has also served as a Principal of Acuity Advisors, LLC, an ophthalmic consulting company, from January 2014 to July 2018. Dr. Brazzell served as Chief Medical Officer of Mimetogen Pharmaceuticals, Inc., a clinical stage biotechnology company, from January 2012 until December 2015. Dr. Brazzell also held several executive positions at Inspire Pharmaceuticals, Inc., or Inspire, a specialty pharmaceutical company focusing on ophthalmic products, including Executive Vice President of Medical and Scientific Affairs from 2010 to 2011, Executive Vice President and Head of Ophthalmology Business from 2009 to 2010, and Senior Vice President of Ophthalmic Research and Development from 2004 to 2008. Prior to joining Inspire, Dr. Brazzell served as Global Head of Clinical R&D and Senior Vice President, U.S. R&D, of Novartis Ophthalmics AG from 2000 to 2004. Dr. Brazzell also served as Vice President, R&D at Ciba Vision Ophthalmics, Inc. and as Associate Director, R&D, at Alcon Laboratories, Inc. Dr. Brazzell received a B.S. in Pharmacy and a PhD in Pharmaceutical Sciences from the University of Kentucky.

Mary Reumuth, CPA – Chief Financial Officer

Ms. Reumuth has served as our Chief Financial Officer since July 2017, Senior Vice President, Finance from February 2017 to July 2017, our Vice President, Finance from December 2014 to February 2017, our Senior Director, Finance from February 2014 to December 2014, as our Corporate Controller from February 2014 to July 2017 and Treasurer since February 2014. Prior to joining us, Ms. Reumuth acted as an independent financial consultant from November 2012 to January 2014 and, prior to that, served as Corporate Controller for Enobia Pharma Corp., or Enobia, a global biopharmaceutical company acquired by Alexion Pharmaceuticals, Inc., from May 2011 to June 2012. Prior to Enobia, Ms. Reumuth served as Director of Finance at Verenium Corporation, or Verenium, a biotechnology company, from December 2007 to March 2011. From 2001 to 2007, Ms. Reumuth held a variety of finance and accounting positions at Genzyme Corporation, or Genzyme, (now a Sanofi Company), and ILEX Oncology, Inc., or ILEX (acquired by Genzyme). Prior to ILEX, she was an auditor at Ernst & Young LLP. She currently served on the board of Olink Holding AB. Ms. Reumuth earned her Bachelor’s degree in Business Administration from Texas A&M University—Corpus Christi, and is a C.P.A.

Darius Kharabi – Chief Business Officer

Darius Kharabi has served as our Chief Business Officer since November 2021. Mr. Kharabi was co-founder and Chief Executive Officer of Combangio Inc., a clinical stage ophthalmology mesenchymal stem cell secretome company that we acquired in November 2021. He is the co-founder and was Chief Operating Officer of Lagunita Biosciences, LLC, an early-stage medical investment company. He helped to create and served in board and executive leadership positions in multiple Lagunita portfolio companies, including xCella Biosciences, acquired by Ligand, Kedalion Therapeutics, acquired by Novartis AG, and Combangio. Prior to Lagunita, he served as Vice President, Corporate Development and International Sales at OrthAlign, a commercial stage orthopedic surgery navigation company, where his responsibilities included the launch of the KneeAlign® total knee arthroplasty navigation product line in the United States and global markets. Mr. Kharabi started his career as a biotechnology licensing attorney at Wilson, Sonsini, Goodrich & Rosati, PC. He received his B.S. in Biochemistry from Georgetown University and his J.D. and M.B.A. degrees from Stanford University.

The Bidding Process for Interested Buyers

Interested and qualified parties will be expected to sign a nondisclosure agreement (attached hereto as (Exhibit A) to have access to key members of the management and intellectual capital teams and the due diligence “war room” documentation (the “Due Diligence Access”). Each interested party, as a consequence of the Due Diligence Access granted to it, shall be deemed to acknowledge and represent (i) that it is bound by the bidding procedures described herein; (ii) that it has an opportunity to inspect and examine the KALA assets and to review all pertinent documents and information with respect hereto; (iii) that it is not relying upon any written or oral statements, representations, or warranties of KALA, Gerbsman Partners, or their respective agents, or attorneys; and (iv) all such documents and reports have been provided solely for the convenience of the interested party, and neither KALA nor Gerbsman Partners (or their respective, agents, or attorneys) makes any representations as to the accuracy or completeness of the same.

Following an initial round of due diligence, interested parties will be invited to participate with a sealed bid for the acquisition of the KALA Assets. Sealed bids must be submitted so that the bid is actually received by Gerbsman Partners no later than Friday, November 7, 2025 at 3:00 p.m. Pacific Time (the “Bid Deadline”) at steve@gerbsmanpartners.com and todd.bazemore@kalarx.com

Bids should identify those assets being tendered for in a specific and identifiableway to also include Bids for the NOL of KALA. Bidders interested in specific KALA Assets must submit a separate bid for such assets. Be specific as to the assets desired or any interest in purchasing the Company as a whole for reason of its tax attributes or otherwise. Bids for assets must include a markup of the draft Asset Purchase Agreement that will be provided to parties executing nondisclosure agreements.

Any person or other entity making a bid must be prepared to provide independent confirmation that they possess the financial resources to complete the purchase where applicable. All bids must be accompanied by a refundable deposit check in the amount of $200,000 (payable to KALA BIO, Inc.). The winning bidder will be notified within 3 business days after the Bid Deadline. Non-successful bidders will have their deposit returned to them. KALA reserves the right to, in its sole discretion, accept or reject any bid, or withdraw any or all assets from sale. Interested parties should understand that it is expected that the highest bid will be chosen as the winning bidder and bidders may not have the opportunity to improve their bids after submission.

KALA will require the successful bidder to close within 7 business days. Any or all of the assets of KALA will be sold on an “as is, where is” basis, with no representation or

warranties whatsoever.

All sales, transfer, and recording taxes, stamp taxes, or similar taxes, if any, relating to the sale of the KALA assets shall be the sole responsibility of the successful bidder and

shall be paid to Kala at the closing of each transaction.

For additional information, please see below and/or contact:

Steven R. Gerbsman

(415) 456-0628

Kenneth Hardesty

(408) 591-7528

Eric Bell

(501) 258-8332

Gerbsman Partners has been retained by KALA BIO, Inc. (“KALA” or “the Company”) to solicit interest for the acquisition of all, or substantially all, of the assets of KALA, to include acquisition of KALA’s public vehicle.

KALA is a clinical-stage biopharmaceutical company dedicated to the research, development and commercialization of innovative therapies for rare and severe diseases of the front and back of the eye.

To date KALA has raised approximately $596 million, primarily from the issuance of equity. This also includes a $15 million grant from the California Institute for Regenerative Medicine (CIRM), for which the Company has received $14.4M as well as proceeds from the sale of equity of $120 million from its initial seed financing through its Series C crossover, $462 million in net proceeds after deducting underwriters’ fees from equity issued beginning with the Company’s IPO in July 2017 through December 31, 2024. In addition, KALA has raised $80 million in debt from Oxford of which $29.1 million, inclusive of exit fee is currently outstanding.

The acquisition of KALA or its assets will enable immediate access to KALA’s proprietary intellectual property, manufacturing protocols, GMP-grade master cell and working cell banks, potency-assay suite, product inventory, manufacturing know-how and trade secrets, and its Persistent Corneal Epithelial Defect (PCED) clinical trial IND approval and data. The Company believes the multifactorial mechanism of action of KPI-012 also makes its MSC-S a platform technology. KPI-012 has the potential to treat additional rare front-of-the-eye diseases, such as Limbal Stem Cell Deficiency (LSCD), and other rare corneal diseases that threaten vision. The Company has also conducted preclinical studies under its KPI-014 program to evaluate the utility of its MSC-S platform for inherited retinal degenerative diseases, such as Retinitis Pigmentosa and Stargardt Disease. As of December 31, 2024, the Company had federal net operating loss, or NOL, carryforwards of $405.5 million, which may be available to offset future federal tax liabilities and expire at various dates beginning in 2030. Additionally, the Company is eligible to receive from Alcon up to four commercial-based sales milestone payments totaling up to $325 million in connection with the July 8, 2022 sale to Alcon of Company commercial assets unrelated to KPI-012/MSC-S.

KALA’s proprietary platform is protected by a patent family comprised of 8 issued US patents and over 40 pending US and ex-US patent applications covering compositions of matter and methods of treatment and manufacture. Additionally, KALA has an exclusive license from Stanford University covering other related patent rights. KPI-012 is regulated as biologic by FDA under CBER and as such would receive 12-year regulatory exclusivity once a BLA is approved. It is assumed that any other products derived from the platform would also be subject to this exclusivity upon BLA approval.

The Company’s product candidate, KPI-012, which it acquired from Combangio, Inc., or Combangio, on November 15, 2021, is a mesenchymal stem cell secretome, or MSC-S, and is currently in Phase 2 clinical development for the treatment of persistent corneal epithelial defects, or PCED, a rare disease of impaired corneal healing. Combangio is currently a wholly-owned subsidiary of KALA. KPI-012 has received Orphan Drug and Fast Track designations from the FDA for the treatment of PCED. While preclinical data and a positive Phase 1b study support the promise of KPI-12 for the treatment of PCED, KALA announced on September 29, 2025 that its CHASE (Corneal Healing After SEcretome therapy) Phase 2b clinical trial of KPI-012 for the treatment of PCED did not meet the primary endpoint of complete healing of PCED as measured by corneal fluorescein staining or achieve statistical significance for key secondary efficacy endpoints.

The Company’s manufacturing process for KPI-012 is currently at commercial scale, with master and working cell banks established and stored at its US-based GMP contract manufacturer. Additionally, KALA has developed a suite of potency assays aligned with FDA expectations for Phase 3 and a BLA submission based on the results of the Company’s April 2024 Type C meeting with the FDA. The Company believes that its CMC, pre-clinical and clinical programs can be leveraged to support development in LSCD and other anterior segment indications outside of PCED and provide a strong foundation for developing MSC-S for the treatment of retinal disease as well non-ophthalmic indications.

IMPORTANT LEGAL NOTICE:

The information in this memorandum does not constitute the whole or any part of an offer or a contract.

The information contained in this memorandum relating to the KALA assets has been supplied by KALA. It has not been independently investigated or verified by Gerbsman Partners or its agents.

Potential purchasers should not rely on any information contained in this memorandum or provided by KALA or Gerbsman Partners (or their respective staff, agents, and attorneys) in connection herewith, whether transmitted orally or in writing as a statement, opinion, or representation of fact. Interested parties should satisfy themselves through independent investigations as they or their legal and financial advisors see fit.

KALA, Gerbsman Partners, and its respective staff, agents, and attorneys, (i) disclaim any and all implied warranties concerning the truth, accuracy, and completeness of any information provided in connection herewith and (ii) do not accept liability for the information, including that contained in this memorandum, whether that liability arises by reasons of KALA or Gerbsman Partners’ negligence or otherwise.

Any sale of the KALA Assets will be made on an “as-is,” “where-is,” and “with all faults” basis, without any warranties, representations, or guarantees, either express or implied, of any kind, nature, or type whatsoever from, or on behalf of KALA or Gerbsman Partners. Without limiting the generality of the foregoing, KALA and Gerbsman Partners and their respective staff, agents, and attorneys, hereby expressly disclaim any and all implied warranties concerning the condition of the KALA Assets and any portions thereof, including, but not limited to, environmental conditions, compliance with any government regulations or requirements, the implied warranties of habitability, merchantability, or fitness for a particular purpose. Certain consents of third-party agreements may be required to obtain and/or utilize KALA assets, and diligence regarding any such consents and obtaining any such consents are responsibilities of the buyer.

This memorandum contains confidential information and is not to be supplied to any person without Gerbsman Partners’ prior consent. This memorandum and the information contained herein are subject to the non-disclosure agreement attached hereto as Exhibit A. Please note that KALA’s equity is publicly-traded and the use and disclosure of information in this memorandum and otherwise provided may be restricted by applicable securities laws, regulations, and other limitations.

Additionally statements contained in this memorandum regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Such statements include, but are not limited to, statements regarding: KALA’s future expectations, plans and prospects, KALA’s expectations with respect to potential advantages of KPI-012 and its MSC-S platform; the clinical utility of KPI-012 for any indication; and the value of KALA’s asset. Any forward-looking statements in this memorandum is based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. Risks that contribute to the uncertain nature of the forward-looking statements include, among others, uncertainties inherent in the initiation, conduct and results of preclinical studies and clinical trials; KALA’s ability to comply with the covenants under its loan agreement, including the requirement that its common stock continue to be listed on The Nasdaq Stock Market; and those other risks and uncertainties set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2025 and June 30, 2025, and in subsequent filings the Company may make with the SEC. All forward-looking statements contained in this memorandum speak only as of the date of this memorandum. KALA anticipates that subsequent events and developments will cause its views to change. However, KALA undertakes no obligation to update such forward-looking statements to reflect events that occur or circumstances that exist after the date of this memorandum, except as required by law.

The strengths of the KALA assets are as follows:

- KPI-012 is a Phase 2 stage program. While KPI-012 did not meet primary and secondary endpoints in the CHASE Phase 2b Clinical Study for PCED, Phase 1b and pre-clinical data support its potential for the treatment of corneal disorders.

- Proprietary MSC-S platform protected by 8 issued US patents and over 40 pending US and ex-US patent applications covering compositions of matter and methods of treatment and manufacture. Additionally, an exclusive license from Stanford University covers other related patent rights.

- KPI-012 is regulated as biologic by FDA under CBER and as such would receive 12-year regulatory exclusivity once a BLA is approved. It is assumed that any other products derived from the platform would also be subject to this exclusivity upon BLA approvals.

- KPI-012 manufacturing process is currently at commercial scale, with master and working cell banks established and stored at its US-based GMP contract manufacturer.

- KPI-012 suite of potency assays aligns with FDA expectations for Phase 3 and a BLA submission based on the results of the Company’s April 2024 Type C meeting with the Agency.

- Multifactorial mechanism of action potentially makes KALA’s MSC-S a platform technology. KPI-012 has the potential to treat additional rare front-of-the-eye diseases, such as Limbal Stem Cell Deficiency (LSCD), and other rare corneal diseases that threaten vision. MSC-S platform may also have utility for inherited retinal degenerative diseases, such as Retinitis Pigmentosa and Stargardt Disease.

- As of December 31, 2024, the Company had federal net operating loss, or NOL, carryforwards of $405.5 million, which may be available to offset future federal tax liabilities and expire at various dates beginning in 2030.

- The Company may be eligible to receive from Alcon up to four commercial-based sales milestone payments totaling up to $325 million in connection with the July 8, 2022 sale to Alcon of Company commercial assets unrelated to KPI-012/MSC-S.

Intellectual Property

KALA’s proprietary platform is protected by a patent family comprised of 8 issued US patents and over 40 pending US and ex-US patent applications covering compositions of matter and methods of treatment and manufacture. These include but are not limited to secretome compositions containing certain proteins believed to be therapeutically relevant, secretomes demonstrating certain favorable performance characteristics in activity tests and secretome formulation elements. This patent portfolio has a 20-year patent term ending in 2040, with the potential for patent term extension. Additionally, KALA has an exclusive license from Stanford University covering other related patent rights. KPI-012 is regulated as biologic by FDA under CBER and as such would receive 12-year regulatory exclusivity once a BLA is approved. It is assumed that any other products derived from the platform would also be subject to this exclusivity upon BLA approval. Schedule B attached.

Fixed Assets

The Company’s fixed assets include mostly lightly used and well-maintained equipment, including many items maintained with up-to-date preventive maintenance and calibration services. The equipment served a general molecular biology and tissue culture laboratory, as well as a small pilot manufacturing group. Assets include key equipment for: 1) general molecular biology and immunoassay (e.g., plate readers, centrifuges, Ella automated immunoassay instruments, chemiluminescent imager, and plate washers); 2) tissue culture (e.g., biological safety cabinets, centrifuges, and CO2 incubators); 3) bio-processing (PBS3 bioreactor system and SF150 tangential flow filtration system, Palltronic Flowstar); and 4) general cold storage (e.g., ultra-low freezers, -20C freezers, chest freezer, refrigerators). A schedule of fixed assets is included as Exhibit C.

KALA Pipeline

The following table describes the stage of each of the Company’s development programs:

KPI-012 and Persistent Corneal Epithelial Defect (PCED)

KPI-012 is a novel, human bone-marrow derived MSC secretome composed of biologically active components secreted from the MSCs, such as growth factors, protease inhibitors, matrix proteins and neurotropic factors, that have been shown in preclinical studies to facilitate corneal healing. KPI-012 is cell-free and produced from a proprietary cell bank. The drug substance for KPI-012 is produced as a chemically-defined cell-free solution followed by formulation and filling of the drug product in non-preserved single dose units.

KALA believes that KPI-012’s multi-factorial mechanism of action has the potential to normalize the impaired healing in PCED and other severe ocular surface diseases driven by impaired healing. As such, KALA believes KPI-012 offers a potentially promising approach for the treatment of PCED and other ocular surface diseases across multiple etiologies. Key biological factors contained in KPI-012 and their potential wound healing functions are shown below:

| Key KPI-012 Components | Ocular Surface Wound-Healing Function |

| Protease inhibitors (e.g., TIMP-1, TIMP-2, Serpin E1) | Inhibit proteases that degrade ECM components in the wound bed and promote uncontrolled inflammatory response |

| Matrix proteins (e.g., fibronectin, collagen) | Facilitate ECM remodeling and assembly in wound bed, supporting cell adhesion, migration, and maturation |

| Growth factors (e.g., HGF) | Suppress inflammation and promote epithelial proliferation, migration, adhesion, and wound re-epithelization |

| Neurotrophic factors (e.g., PEDF) | Promote maintenance and regrowth of neurons to support corneal health and epithelial function and survival |

The multifactorial mechanism of action of KPI-012 is thought to be responsible for the significant wound healing activity observed in preclinical animal models and in the completed Phase 1b clinical trial. KPI-012 has received Orphan Drug and Fast Track designations from the FDA for the treatment of PCED.

PCED

PCED is a persistent non-healing corneal defect or wound that is refractory to conventional treatments. PCED is a disease of impaired corneal healing and can be the result of numerous etiologies, including (but not limited to) neurotrophic keratitis, or NK, microbial/viral keratitis, surgical epithelial debridement, corneal transplant surgery, LSCD, mechanical/thermal trauma and exposure keratopathy. Normal healing is a highly regulated multifactorial process that involves numerous biologic pathways and molecules, including growth factors, cell signaling, proliferation, migration and extracellular matrix remodeling. In PCED, the normal healing process is impaired due to an imbalance of the key biomolecules that orchestrate the normal wound healing process. KALA believes that effective treatment of PCED across the various etiologies requires a multifactorial mechanism of action to address the impaired healing that is responsible for the defects.

PCED is a rare disease with an estimated incidence of 100,000 cases per year in the United States and 238,000 cases per year in the United States, European Union and Japan combined. Clinical symptoms of PCED include pain, foreign body sensation, redness, photophobia and tearing. Clinical signs include non-healing epithelial defects, stromal scarring and stomal thinning. A PCED may lead to infection, corneal ulceration, corneal perforation, scarring, opacification and significant vision loss.

There is currently a significant unmet need for therapies to effectively treat PCED. Conventional therapies, which include bandage contact lenses, autologous serum and surgery, are usually ineffective in overcoming the dysregulation present in multiple cellular pathways that may need to be addressed to heal a PCED. Surgical procedures used in the treatment of PCED include tarsorrhaphy, corneal epithelial stem cell transplants and corneal transplants which are used to aid in restoration and maintenance of vision capabilities.

Competition – Oxervate

The only currently approved prescription product in the PCED space is Oxervate®, indicated for the treatment of NK, which we believe to be the primary etiology for approximately one-third of PCED cases. Oxervate contains a single growth factor – nerve growth factor (NGF) – and has been demonstrated to be effective in only the subgroup of PCED cases whose underlying etiology is neurotrophic disease. Oxervate is a topical eye drop that is administered six times per day at two-hour intervals for eight weeks. Each administration of Oxervate requires the use of a vial containing the drug product, a vial adapter, a single-use pipette and disinfectant wipes. The manufacturer of Oxervate, Dompe Farmaceutici, reported over $1.1B in Oxervate sales in 2024.

KPI-012 PCED Clinical Development

CHASE Phase 2b Clinical Study

Based on the positive results of a Phase 1b clinical safety and efficacy trial of KPI-012 in patients with PCED, along with favorable preclinical safety and efficacy results, the Company submitted an investigational new drug application, or IND, to the U.S. Food and Drug Administration, or FDA, which was accepted in December 2022. In February 2023, KALA dosed its first patient in the United States in our CHASE (Corneal Healing After SEcretome therapy) Phase 2b clinical trial of KPI-012 for PCED, or the CHASE trial.

As reported on September 29, 2025, KALA’s CHASE Phase 2b clinical trial failed to achieve statistical significance for its primary and secondary endpoints and did not show any meaningful difference between either KPI-012 treatment arm and the placebo arm. KPI-012 was well-tolerated with no treatment-related serious adverse events observed. The CHASE Phase 2b trial is a multicenter, randomized, double-masked, vehicle-controlled, parallel-group study to evaluate the safety and efficacy of two doses of KPI-012 ophthalmic solution (3 U/mL and 1 U/mL) versus vehicle dosed topically QID for 56 days. The CHASE trial randomized 79 patients across 37 sites in the United States and Latin America with verified PCEDs at baseline were eligible for inclusion in the primary efficacy analysis.

Phase 1b Clinical Study

Combangio, prior to its acquisition by KALA, conducted a Phase 1b clinical trial of KPI-012 in Mexico City, Mexico during 2020 and 2021, consisting of three subjects without active corneal disease, or the safety cohort, who were dosed twice a day (1 U/mL) for one week and nine patients with PCED, or the PCED cohort, who were dosed twice a day (1 U/mL) for up to eight weeks.

The participants in the Phase 1b trial were treated with KPI-012 topically twice a day, with the subjects in the safety cohort treated for one week and patients in the PCED cohort treated between one to eight weeks. KPI-012 was generally well tolerated in both cohorts, with only one subject experiencing treatment-related adverse events (mild and transient itching, red eye and blurred vision after study drug administration). There were no deaths or treatment-related serious adverse events during either cohort. One subject in the PCED cohort had to withdraw from the trial due to a protocol screening violation.

As depicted in Figure 1 below, six of the eight patients in the PCED cohort (75%) who completed the trial achieved complete healing of the lesion after four weeks of treatment, with the two other patients experiencing some clinical improvement but not complete healing. Four of eight patients in the PCED cohort (50%) achieved complete healing of the lesion after one week of treatment and the other two patients achieved complete healing within two to four weeks of initiation of treatment with KPI-012. All six of the patients who achieved complete healing remained healed through the follow-up period of the trial, which ranged between eight to 19 weeks. Of the two patients who did not show complete healing in the trial, clinical investigators noted some clinical improvement in both patients, but the corneal staining images did not show complete healing of the defect.

Figure 1. Summary of Phase 1b clinical trial of KPI-012 for PCED, including representative images for a healed patient study eye. The Day 1 images were taken on the first day of treatment, prior to first KPI-012 administration, with the fluorescein (green) stain demarking the corneal wound boundary of the study eye image. The Day 7 images were taken on the last day of KPI-012 treatment showing the PCED completely healed. The images on the left depict the study eye viewed under blue light to visualize the PCED with fluorescein stain.

KPI-012 Preclinical Studies and Results

KPI-012 was evaluated in several preclinical studies. In these studies, KPI-012 promoted rapid ocular re-epithelialization and mitigated scarring and neovascularization in several well-established animal models.

In vitro Human Corneal Epithelial Wound Closure Assay

The therapeutic mechanism of action of KPI-012 involves stimulating corneal re-epithelialization and ocular surface healing. Combangio evaluated KPI-012 in an in vitro wound gap assay developed using human corneal epithelial cells. In this assay, a mechanical defect (cell-free region) was introduced into a two-dimensional monolayer of epithelial cells to create a wound. The ‘injured’ monolayer was then treated with KPI-012 and the cell free region was monitored for wound closure as show in Figure 2 below. In this assay, KPI-012 exhibited a dose-dependent and potent wound closure response.

Figure 2. Representative images from an in vitro human corneal epithelial wound closure assay. A mechanical wound instilled to a corneal epithelial cell monolayer on Day 1 healed after treatment with KPI-012 (Day 4 of treatment), but not negative control (vehicle). Depicted images are wounded cell monolayers stained with Gentian Violet.

In vivo Mechanical Wound Studies of Activity

The activity of KPI-012 was also evaluated in a mechanical corneal injury mouse model. In this model, a circular area on the surface of the cornea was debrided (mechanically scraped) to remove the epithelial layer and create a circular wound.

Topical formulations of vehicle or KPI-012 were administered twice daily to the wounded eyes. As shown in Figure 3 below, mice treated with KPI-012 exhibited prominent wound healing at day four of the treatment period, while the vehicle-treated wounded eyes remained largely unhealed. Further, treatment with KPI-012 resulted in reduced corneal haze and scarring relative to treatment with vehicle. Results of this mouse model suggested that at Day 4 of treatment KPI-012 promoted in vivo closure of cornea mechanical wounds relative to vehicle control.

Figure 3. Representative images of wounded mouse corneas after mechanical injury (Day 1). Depicted is the fluorescein (green) stain, which demarks the corneal wound boundary. Treatment with KPI-012 rapidly healed the wound size (as indicated by the disappearance of the green stain by Day 4) relative to vehicle control-treated eyes.

Other Potential Indications for KPI-012 and KALA MSC-S Platform

Other Potential Indications of KPI-012

KALA believes the multifactorial mechanism of action of KPI-012 also makes it a platform technology, with the potential to treat additional rare front-of-the-eye diseases such Limbal Stem Cell Deficiency (LSCD).

LSCD is an ocular surface disease characterized by the loss or deficiency of stem cells in the junction of the cornea and limbus, where they play an essential role in the generation and repopulation of corneal epithelial cells. When the limbal stem cell population is reduced or depleted, the ability of the corneal epithelium to repair and renew itself is compromised, which can result in recurrent epithelial breakdown, neovascularization, conjunctival overgrowth and other sequalae that can lead to loss of corneal clarity and vision impairment, as well as significant pain and diminished quality of life. With the exception of the autologous stem cell product Holoclar, which is approved in the European Union for treatment of LSCD caused by ocular burns, there are currently no approved pharmaceutical products for the treatment of LSCD and there are an estimated 100,000 patients in the United States suffering from this disease. We believe these patients may be appropriate candidates for KPI-012 to maintain the integrity of the ocular surface and to avoid the vision impairment and pain associated with the disease. In addition to the effects of KPI-012 on corneal healing observed in both animal models and in PCED patients, there is data in the literature that suggest that MSC-S can restore the limbal stem cell niche, which would be of significant benefit in both partial or complete LSCD.

Other MSC-S Platform Applications

The Company also has a program targeting to develop a unique secretome formulation – designated as KPI-014 – specific for inherited retinal degenerative diseases. KALA initiated preclinical studies under our KPI-014 program to evaluate the utility of our MSC-S platform for inherited retinal degenerative diseases, such as Retinitis Pigmentosa and Stargardt Disease. MSC-S therapies have shown great promise to treat inherited retinal diseases, or IRDs, with the recognition that they function through their secretome (i.e., the secretion of paracrine factors that enhance retinal cell function and survival). KALA believes an MSC-S engineered for intravitreal delivery may provide an improved treatment option for IRDs as compared to the traditional MSC-based approach.

KALA’s MSC-S development and manufacturing program may also provide a foundation for secretome-based product development outside of ophthalmology. Published third party studies have supported the promise of mesenchymal stem cell secretome in multiple indications outside of ophthalmology, including skin wounds, lung injury, myocardial infarction, stroke and spinal cord injury.

KPI-012 Manufacturing Process

The Company is currently manufacturing KPI-012 at commercial scale for PCED at two contract manufacturers, BioBridge Global (secretome Drug Substance; San Antonio, Texas) and Woodstock Sterile Solutions (filled and finished Drug Product; Woodstock, Illinois). Final Drug Product is currently manufactured using industry-standard unit dose blow-fill-seal formulation and filling process. Final Drug Product is released based on product potency, consistency and stability methods consistent with FDA Pre-IND meeting feedback, including protein Critical Quality Attributes (CQAs) and a cell-based potency assay.Validated assays have been developed for protein CQAs, with multiple engineering batches assaying CQAs and additional KPI-012 constituents supporting a robust and consistent manufacturing process. Based on a Type C meeting with FDA in April 2024, KALA’s CMC and potency assay program is aligned with FDA expectations for Phase 3 and a BLA submission. The KPI-012 PCED CMC program and other IND-enabling activities have the potential to be leveraged to support development in LSCD and other anterior segment indications outside of PCED.

Alcon Transaction

The Company previously developed and commercialized two marketed products, EYSUVIS® (loteprednol etabonate ophthalmic suspension) 0.25%, for the short-term (up to two weeks) treatment of the signs and symptoms of dry eye disease, and INVELTYS® (loteprednol etabonate ophthalmic suspension) 1%, a topical twice-a-day ocular steroid for the treatment of post-operative inflammation and pain following ocular surgery. Both products applied a proprietary mucus-penetrating particle drug delivery technology, which the Company referred to as the AMPPLIFY® Drug Delivery Technology. This technology and the associated products were unrelated to KPI-012 or the Company’s MSC-S platform.

On July 8, 2022, the Company closed the transaction (the “Alcon Transaction”), contemplated by the asset purchase agreement, dated as of May 21, 2022 (the “Asset Purchase Agreement”), by and between the Company, Alcon Pharmaceuticals Ltd. and Alcon Vision, LLC (together referred to as “Alcon”), pursuant to which Alcon purchased the rights to manufacture, sell, distribute, market and commercialize EYSUVIS and INVELTYS and to develop, manufacture, market and otherwise exploit the Company’s AMPPLIFY Drug Delivery Technology (collectively, the “Commercial Business”). Alcon also assumed certain liabilities with respect to the Commercial Business at the closing of the Alcon Transaction. Alcon paid to the Company an upfront cash payment of $60 million upon the closing of the Alcon Transaction. In addition, pursuant to the Asset Purchase Agreement, the Company may beeligible to receive from Alcon up to four commercial-based sales milestone payments totaling up to $325 million as follows: (1) $25 million upon the achievement of $50 million or more in aggregate worldwide net sales of EYSUVIS and INVELTYS in a calendar year from 2023 to 2028, (2) $65 million upon the achievement of $100 million or more in aggregate worldwide net sales of EYSUVIS and INVELTYS in a calendar year from 2023 to 2028, (3) $75 million upon the achievement of $175 million or more in aggregate worldwide net sales of EYSUVIS and INVELTYS in a calendar year from 2023 to 2029 and (4) $160 million upon the achievement of $250 million or more in aggregate worldwide net sales of EYSUVIS and INVELTYS in a calendar year from 2023 to 2029. Each milestone payment will only become payable once, if at all, upon the first time such milestone is achieved, and only one milestone payment will be paid with respect to a calendar year. In the event that more than one milestone is achieved in a calendar year, the higher milestone payment will become payable and the lower milestone payment will become payable only if the corresponding milestone is achieved again in a subsequent calendar year. The Company has not been entitled to any milestone payment to date.

Net Operating Losses

As of December 31, 2024, the Company had federal net operating loss, or NOL, carryforwards of $405.5 million, which may be available to offset future federal tax liabilities of KALA and which expire at various dates beginning in 2030. As of December 31, 2024, KALA also had state NOL carryforwards of $469.1 million, which may be available to offset future state income tax liabilities of KALA and expire at various dates beginning in 2025. As of December 31, 2024, KALA had $2.5 million federal and state research and development credit carryforwards. The Company’s NOL carryforwards could expire unused and be unavailable to offset our future income tax liabilities.

In general, under Sections 382 and 383 of the Code, the amount of benefits from the Company’s NOL and research and development tax credit carryforwards, respectively, may be impaired or limited if we incur an “ownership change,” generally defined as a greater than 50% change (by value) in equity ownership by certain stockholders, over a three-year period. KALA previously completed an analysis and determined that an ownership change has materially limited the Company’s net operating loss carryforwards and research and development tax credits available to offset future tax liabilities. During December 2022, an additional ownership change occurred as a result of the Company’s entry into the securities purchase agreement for the private placement transaction. As a result of this ownership change, the utilization of the Company’s net operating loss carryforwards is subject to an annual limitation of $0.2 million. KALA may be further limited by any changes that may have occurred or may occur subsequent to December 31, 2022, including any change resulting from the purchase of the Company has not completed an analysis as of December 31, 2024. Any buyer interested in monetizing KALA’s tax attributes should seek its own tax advice and should not rely on any statement of KALA or its advisors.

Seasoned Management Team

KALA’s management team includes:

Todd Bazemore – President & CEO

Mr. Bazemore brings over 30 years of experience across ultra-rare orphan diseases to large primary care conditions. He previously served as KALA BIO’s interim Chief Executive Officer from February 2025 to September 2025 and as its Chief Operating Officer from November 2017 to February 2025. Prior to joining the company, Todd served as Executive Vice President and Chief Operating Officer of Santhera Pharmaceuticals (USA), Inc. responsible for U.S. operations from September 2016 to November 2017. Before that, between April 2014 and January 2016, Mr. Bazemore served as Executive Vice President and Chief Commercial Officer of Dyax Corp. where he was responsible for global commercial strategy and oversight of all commercial functions up until Dyax was acquired by Shire plc. Prior to joining Dyax, he was at Sunovion Pharmaceuticals, Inc., previously Sepracor Inc. prior to its acquisition by Dainippon Sumitomo Pharma where he launched 7 new products in an 11-year span while serving in several roles of increasing responsibility including Vice President, Managed Markets, Vice President of Sales, and Vice President of the Respiratory Business Unit.

Kim Brazzell, PhD – Head of R&D and Chief Medical Officer

Dr. Brazzell has served as our Chief Medical Officer since February 2013. He has also served as a Principal of Acuity Advisors, LLC, an ophthalmic consulting company, from January 2014 to July 2018. Dr. Brazzell served as Chief Medical Officer of Mimetogen Pharmaceuticals, Inc., a clinical stage biotechnology company, from January 2012 until December 2015. Dr. Brazzell also held several executive positions at Inspire Pharmaceuticals, Inc., or Inspire, a specialty pharmaceutical company focusing on ophthalmic products, including Executive Vice President of Medical and Scientific Affairs from 2010 to 2011, Executive Vice President and Head of Ophthalmology Business from 2009 to 2010, and Senior Vice President of Ophthalmic Research and Development from 2004 to 2008. Prior to joining Inspire, Dr. Brazzell served as Global Head of Clinical R&D and Senior Vice President, U.S. R&D, of Novartis Ophthalmics AG from 2000 to 2004. Dr. Brazzell also served as Vice President, R&D at Ciba Vision Ophthalmics, Inc. and as Associate Director, R&D, at Alcon Laboratories, Inc. Dr. Brazzell received a B.S. in Pharmacy and a PhD in Pharmaceutical Sciences from the University of Kentucky.

Mary Reumuth, CPA – Chief Financial Officer

Ms. Reumuth has served as our Chief Financial Officer since July 2017, Senior Vice President, Finance from February 2017 to July 2017, our Vice President, Finance from December 2014 to February 2017, our Senior Director, Finance from February 2014 to December 2014, as our Corporate Controller from February 2014 to July 2017 and Treasurer since February 2014. Prior to joining us, Ms. Reumuth acted as an independent financial consultant from November 2012 to January 2014 and, prior to that, served as Corporate Controller for Enobia Pharma Corp., or Enobia, a global biopharmaceutical company acquired by Alexion Pharmaceuticals, Inc., from May 2011 to June 2012. Prior to Enobia, Ms. Reumuth served as Director of Finance at Verenium Corporation, or Verenium, a biotechnology company, from December 2007 to March 2011. From 2001 to 2007, Ms. Reumuth held a variety of finance and accounting positions at Genzyme Corporation, or Genzyme, (now a Sanofi Company), and ILEX Oncology, Inc., or ILEX (acquired by Genzyme). Prior to ILEX, she was an auditor at Ernst & Young LLP. She currently served on the board of Olink Holding AB. Ms. Reumuth earned her Bachelor’s degree in Business Administration from Texas A&M University—Corpus Christi, and is a C.P.A.

Darius Kharabi – Chief Business Officer